[2 min read]

[Key Notes]

- Trade signals do not supplment a trading

system

- More is required for successful trading

than a crypto trade signal can provide.

- Inconsistent results develop from

inconsistent actions

- The cryptocurrency market is too large to

scan by yourself

- Leverage the professional traders at

NewWave Traders to identify high

probability trade setups for you with

updates that average a 75% win rate, 5+

profit factor and 3:1 P/L Ratio.

I want to take a moment to discuss the power and misuse of trade signals so that you avoid common mistakes in the industry.

Starting out trading crypto signals seem like an efficient and smart way to start making profits. Even after trying to trade for a while and not being as successful as you desire it's easy to get turned onto these signal types of services. This is the misuse of signals.

I was really no different starting out and even when I was getting burnt out trying to figure out trading signals seemed like the easier and more intelligent choice. Let more experienced traders tell me when to buy and sell...

Unfortunately this is the misuse of trade signals and garners a bad rep for signal providers as these individuals tend to see poor results. Why is this? There is more to trading then just buying and selling. You have risk management, position sizing, trade psychology and more.

So where is the power in trade signals then?

The power comes from the proper leveraging of these services. The market is huge and takes a lot of time to cover yourself to identify trade signals. As such, it can be very beneficial to leverage other experts that can highlight "potentially" good trades for you. Instead of looking through the market, you can scan these signal channels and then just check out the signals posted and run them through your trade system and see if your strategies can be applied to it.

If you can apply your strategy over one of the signals posted then you've found not only a good trade according to your system but found confluence with someone else's system.

This can fill in the missing components that a trade signal lacks to supply as those missing components are specific to you.

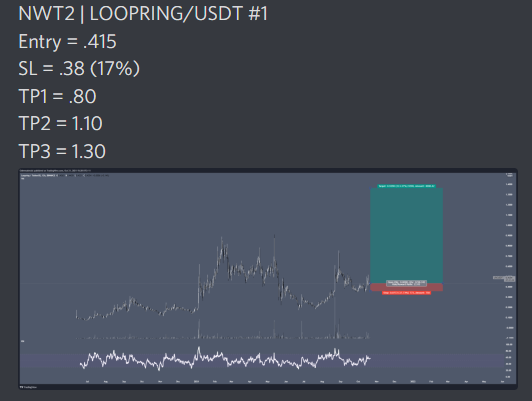

This is why we created the NewWave Signals Discord. It's a way for experienced traders to leverage our expertise to identify high probability trade setups for them. It's also a great final destination for student's that have completed the NewWave Academy and have been trained to think and manage trades the same way we do and better understand the trade signals.

It's quite brilliant of an experience to have like-minded traders utilizing the same system and leveraging a trade signals group that uses that same system as well. It's like having hundreds of traders watching the market 24/7 for each other.

If you'd like to leverage our signals channel responsibly then check it out here: https://www.tradethewave.com/discordsignals

You can also see our trade journal performance there and testimonials from members to provide you with further insight to make an educated decision.